IDBI Bank Women’s Debit Card,its features, benefits, and how to apply for one?

WHAT IS IDBI BANK WOMEN’S DEBIT CARD?

IDBI Women’s Debit Card is especially designed for women offering special advantages and features. You can take your debit card along with you whether you are in India or overseas. The card offers special advantages and features which will be convenient shopping or paying bills. This card has a limit of Rs 40,000. This card also provides loyalty points. This card is VISA card which is packed with exciting offers and rewards and also provides 24/7 customer service.

FEATURES OF IDBI Women’s Card.

The card is packed with a lot of features and also offers a lot of advantages. Some of them are:

ACCESS TO ALL ATM: The card provides access to all ATM, which mean you can withdrawal cash, check balance enquiries etc. The card provides a limit of Rs 40,000 per day. There is no usage charge on IDBI Bank’s ATM or any ATMs shared over India’s shared ATM networks.

INSURANCE COVER: The card provides insurance covers upto Rs 1 lakh, in case of lost or clone cards.

ONLINE SHOPPING: The card be used to shopping, paying bills, booking tickets. The transactions are carried our and verified online by VISA.

VALIDITY: The card is valid worldwide. The card comes with a validity of 5 years.

PURCHASE LIMITS: The cards has withdrawal limit and purchase limit up to Rs 40,000.

ADVANTAGES OF IDBI Women’s Card.

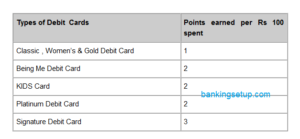

REWARDS: Get rewards on your daily use of the card. Earn 1 loyalty point for every Rs 100 you spent using the card.

This does not applicable with transactions of Mutual Funds, IRCTC payments, Educational institute payments, Insurance premium payments, Government tax payments.

CUSTOMER SERVICE: You can get support from their end 24/7

TRACK YOUR PURCHASES: You can track your purchases daily and also have access to all the transactions you made with transaction date, merchant name and amount in your statement.

DISCOUNTS: Get discounts and offers from selected merchants with your card.

HOW TO APPLY FOR IDBI’s Women card?

If you have an account in IDBI bank you can opt for this card by calling IDBI on 1800-22-1070 or 1800-200-1947. You can also write to customercare@idbi.co.in and request for the card.

If you don’t have an account in IDBI bank, fill out the form and opt for this debit card.

DOCUMENTS REQUIRED.

- Aadhar Card.

- Pan Card.

- Driving License.

- Voter ID.

- Passport (Mandatory for NRI’s)