ICICI Bank increases credit card fees effective February 10

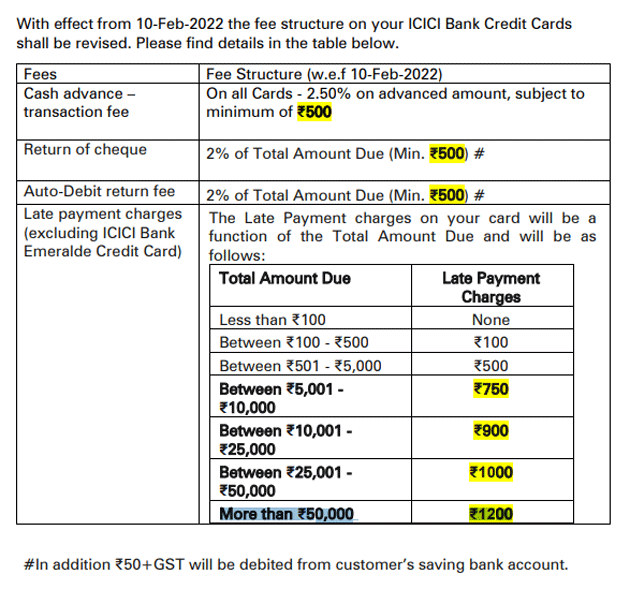

An email sent out on Saturday by ICICI Bank indicated that the bank has raised costs for credit card services such as late payment penalties. Your ICICI Bank Credit Card fee structure will be altered as of 10-Feb-22, Dear Customer. ICICI Bank credit cardholders received a message from MITC saying, “Please visit bit.ly/3qPW6wj for more information on MITC.”

Customers of ICICI Bank credit cards will be required to pay a 2.50 percent transaction fee on all cash advances, with a minimum of Rs 500, starting of February 10, 2022. Now, if the bank receives a returned check for more than Rs 500, it will charge 2 percent of that amount.

What is a cash advance?

A cash advance is the ability to withdraw money from your credit card. There is no limit to how many times you can use your debit card to withdraw cash; the interest rate metre begins the moment you do. A transaction fee may be imposed on foreign currency cash withdrawals made when travelling outside of the country. It is better to prevent cash withdrawals unless it is absolutely necessary. Also, refrain from making a large number of minor withdrawals. That could result in a costly fix.

Late fines rise

Except for the ICICI Bank Emerald Credit Card, the bank reduced late payment fees. Late fees are based on total due. The bank would not charge you if your total due is less than Rs 100. For bigger amounts, the costs increase with the owing amount. The maximum price is Rs 1200 for amounts over Rs.50,000.

What to do if you can’t pay on time?

If you haven’t paid your credit card bill by the due date, you should avoid using it to prevent increasing your interest payments (credit-free period). If you have trouble repaying large sums, you can convert them into EMIs (equivalent monthly instalments).

To pay off your credit card debt in one go, experts advise taking for a personal loan from any lender.