PhonePe, a popular mobile payment app in India, has recently introduced PhonePe UPI Lite support, a new feature that allows users to make payments without entering a UPI PIN. This development is expected to revolutionize the mobile payment industry in India, as it will offer users a faster and more convenient way to transfer funds between bank accounts.

How to enable PhonePe Lite?

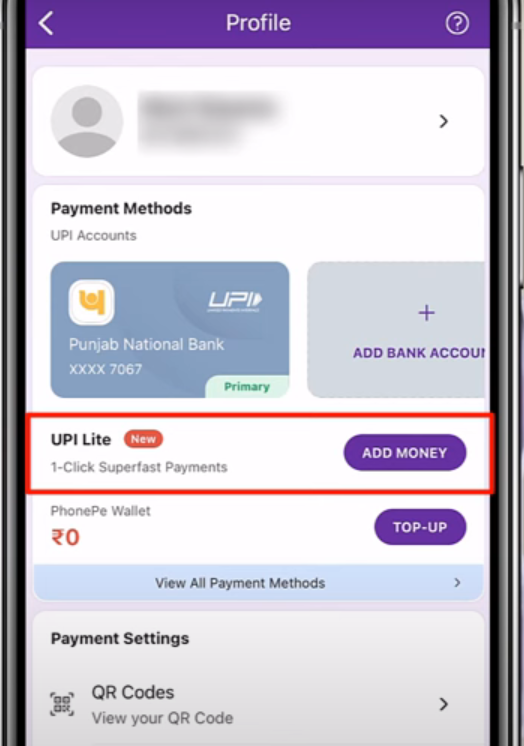

- Go to your PhonePe Profile and look for UPI Lite option as shown below

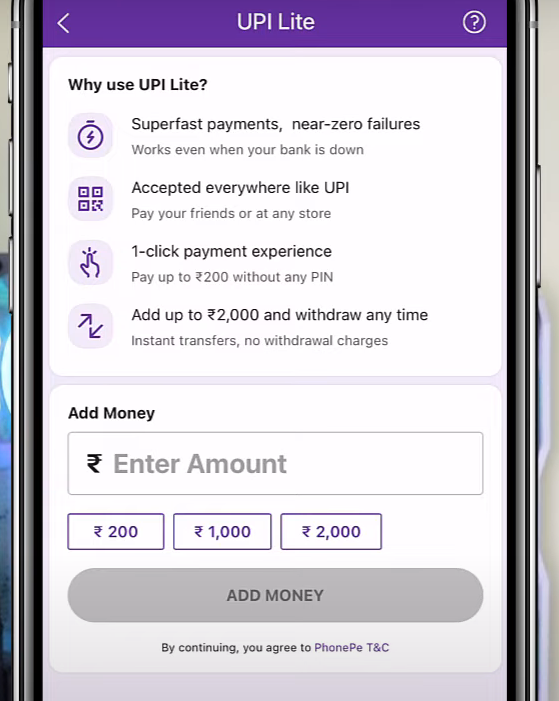

2. Enter the amount you want to add to the UPI account and in the next step it was ask for UPI PIN for once.

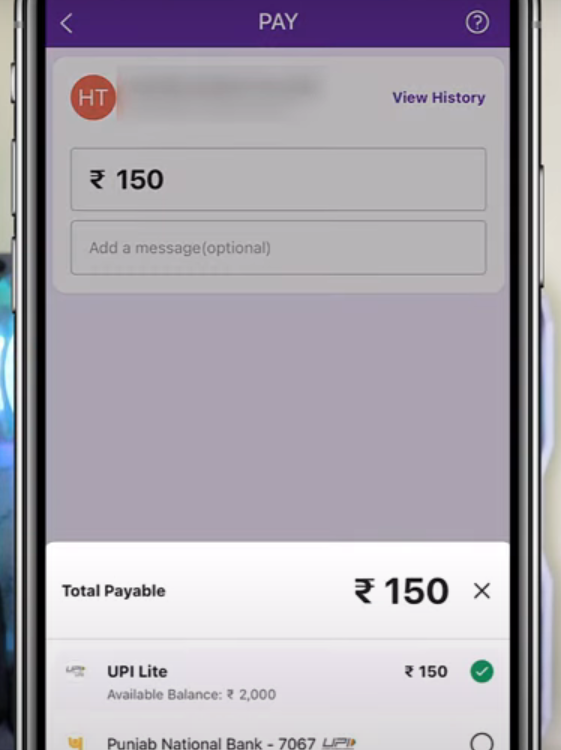

3. While making payment to your vendor select UPI Lite option as payment method

How to Close PhonePe UPI Lite account and get the PhonePe UPI Lite balance back to your account?

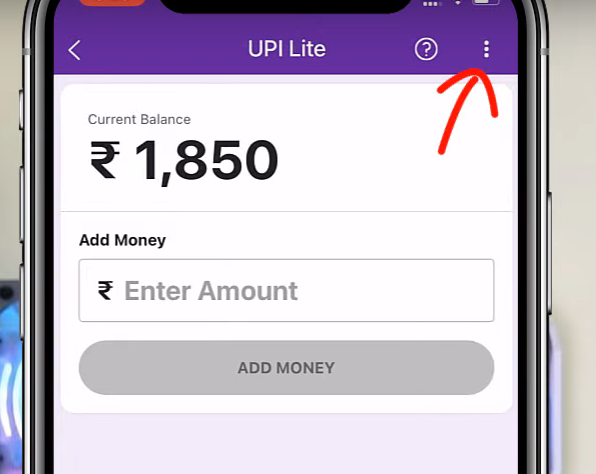

- Go to profile and select UPI Lite and as mentioned in the below screenshot, click on three dots at right top corner

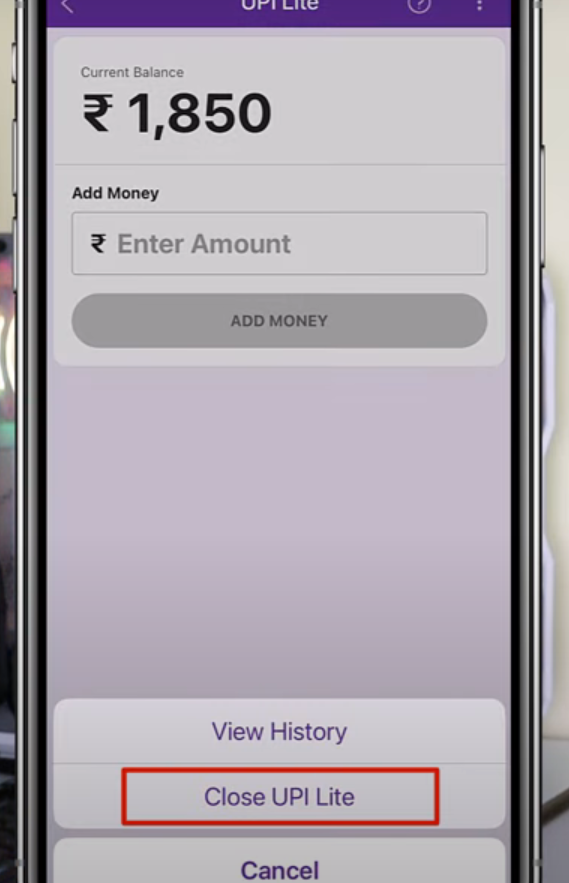

2. Choose Close UPI Lite as shown below

3. Click yes to close UPI Lite

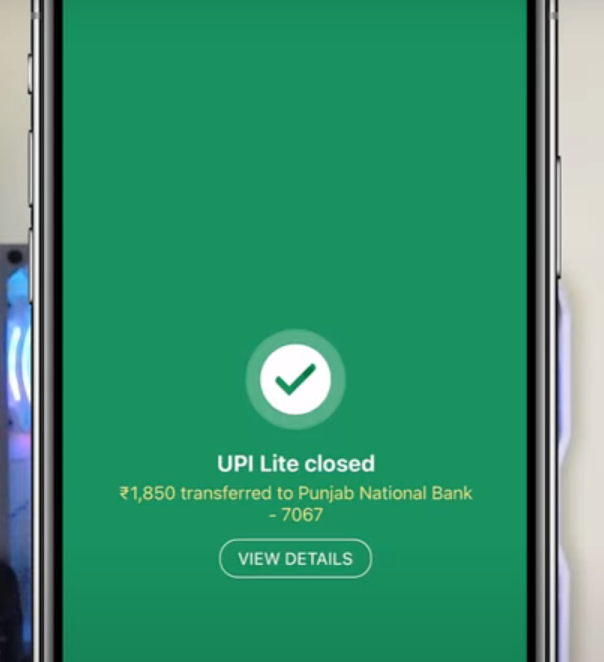

4. Your UPI Lite account will be closed and balance amount is transferred to your primary bank account at no cost.

The introduction of UPI Lite support in PhonePe has several benefits for users. Firstly, it reduces the risk of PIN theft or misuse, as users no longer need to enter their UPI PIN every time they make a payment. Secondly, it is expected to increase the adoption of mobile payments among non-tech-savvy users, who may find the UPI PIN system too complicated or time-consuming. Finally, UPI Lite support makes the payment process faster and more convenient, as users can now complete transactions with just a few taps on their mobile device.

While UPI Lite support offers several benefits, it also has some limitations and potential risks. One of the main risks is the increased potential for fraud and unauthorized transactions, as the lack of a UPI PIN means that anyone who gains access to a user’s mobile device can make payments on their behalf. Furthermore, UPI Lite support lacks security features such as two-factor authentication, which could make it easier for hackers or cybercriminals to misuse the system. Therefore, it is important for users to be vigilant and take necessary precautions to protect their mobile devices and personal information.

In conclusion, the introduction of UPI Lite support in PhonePe is a significant development in the mobile payment industry in India. While it offers several benefits, such as faster and more convenient payments, it also has some potential risks, such as the increased potential for fraud and unauthorized transactions. Therefore, it is important for users to be aware of these risks and take necessary precautions to protect their personal information. Overall, UPI Lite support is expected to increase the adoption of mobile payments in India and pave the way for a more cashless economy.