How do I turn my HDFC credit card bill into EMIs through online ?

If you make a major purchase using a credit card, you must pay the issuing bank by the due date that follows. You will be charged a late payment fee and a high interest rate if you do not pay by the due date.

You won’t have to pay the complete purchase price at once if you divide your payment into Equated Monthly Instalments (EMIs). When it comes to credit card “loans,” HDFC Bank claims that the monthly interest rate is lower than the interest rate paid for late payments, and it is determined according to monthly lowering balance.

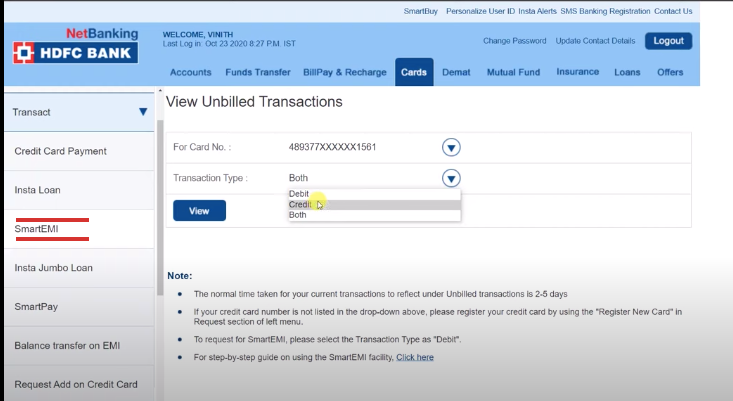

- HDFC Bank NetBanking account login is the first step

- The ‘Cards’ tab is the second step.

- Click ‘Transact’ under Credit Card, then ‘SmartEMI.’

- This is the fourth and last step, where you’ll get a list of any unbilled transactions. Decide on a specific card to use.

- Select “Debit” as your transaction type in step

- Select ‘View’ from the drop-down menu.

You’ll see a list of all of your SmartEMI-eligible Credit Card transactions and be given the opportunity to ‘click’ to find out more about your status. - To convert a specific transaction due amount into EMIs, select the ‘click’ option.

Choosing the right repayment period is the final step. Once you’ve chosen a term, the interest rate is determined based on your qualifications. - Accept the terms and conditions by clicking “submit.” The final summation of loan data will be shown.

An acknowledgement message and reference loan number are delivered to the registered mobile number upon confirmation of the transaction. You can select a payback term ranging from six to twenty-four months, depending on your needs.

How can I use PhoneBanking to convert my HDFC credit card balance into EMIs?

This information is based on the HDFC website “You can use the internet to find the local customer service number and give it a call. Inform the customer service representative of the interest rate, the amount available, and the repayment period. Your loan will be granted immediately without the need for additional documentation once confirmation has been received. Using this service, you can convert your HDFC Credit Card bill into an EMI.”

Eligibility

HDFC Your HDFC credit card bill can be converted into an EMI using Smart EMI option. However, in order to convert, you must be eligible to do so. You should also keep in mind that if you choose for SmartEMI, your credit limit will be lower.

In cases where EMI is not an option

Credit card purchases of gold and jewellery are not eligible for EMIs. In addition, transactions that have lasted more than 60 days are not eligible for review.

Charges and fees

A credit card bill payment can be converted into a monthly instalment plan (EMI) at different rates depending on the bank you choose to work with. A minor one-time processing fee may be charged by some banks; however, others may offer this service for free. A pre-closure fee may be imposed if you decide to pay off the loan earlier than intended. So, it’s a good idea to read the fine print before deciding to use the EMI option.

The EMI option should only be used in an emergency when a person cannot pay their credit card bills on time and has explored all other choices before converting. Before signing up for an EMI, compare the interest rates on credit card EMIs with those on personal loans or top-up loans. You should select the cheapest option from the available choices.